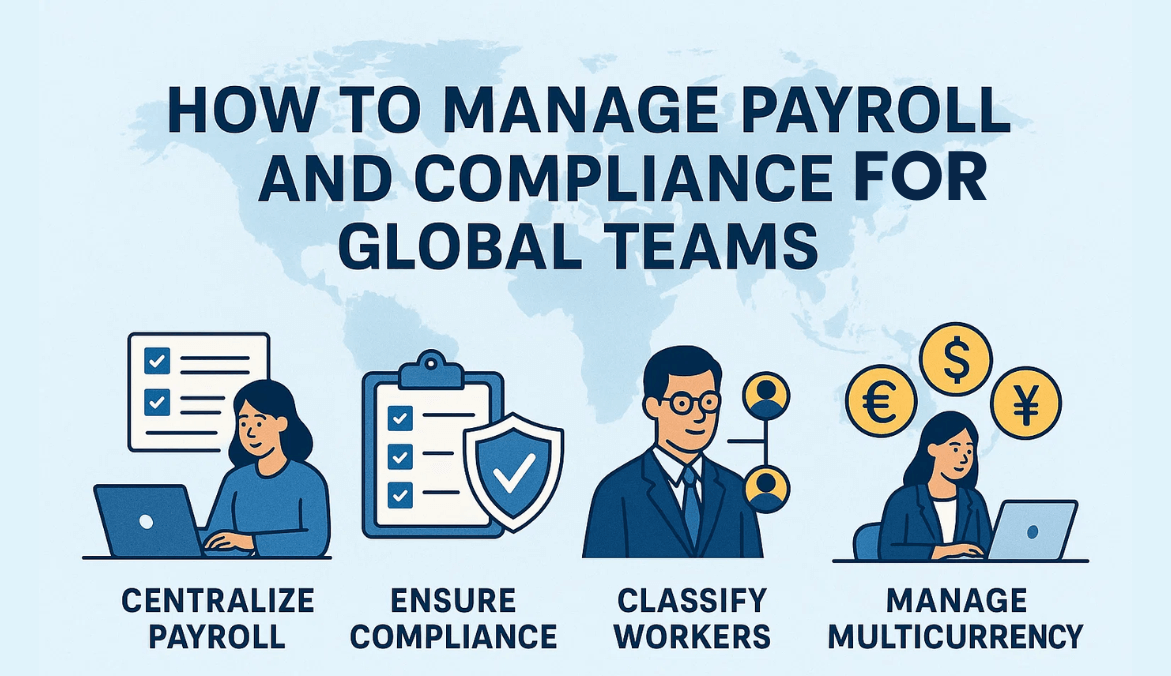

Introduction

Managing global payroll and compliance is a complex process, but it is crucial for a business’s success. It is more than just paying salaries. It also involves navigating the complex local laws, data privacy regulations, and tax codes. Non-compliance can cause reputational damage, loss of employee trust, and severe penalties.

A 2024 report revealed that 53% of global businesses have incurred penalties for payroll non-compliance in the past five years, highlighting the growing risks of mismanagement. Another study found that 49 percent of workers actively explore new employment options after two back-to-back payroll errors. It clearly shows the importance of global payroll and compliance management.

Now, are you wondering how to manage payroll & compliance efficiently for your global teams? This guide covers everything you need to know to ensure successful and seamless payroll and compliance management.

Before diving into the guide on how to manage global payroll, let’s take a look at this 10-point global payroll compliance checklist for 2025, covering data, financial, and legal compliance essentials for a business.

- Classify contractors vs employees correctly.

- Accurately calculate local taxes and social security contributions.

- Align with local social security and tax laws

- Set up region-specific pay frequency and cycles rules

- Deploy robust data privacy and security measures, adhering to PDPA, LGPD, GDPR, etc.

- Use secure global payroll systems with advanced security features.

- Effectively manage currency exchange and conversion rate changes.

- Always maintain necessary evidence and documents for audit readiness.

- Automate processes like deductions, timesheets, and data validations.

- Maintain clear communication with employees to prevent dissatisfaction.

Now, let’s begin with the importance of payroll and compliance for Global teams.

Why Payroll & Compliance Matter for Global Teams

Have you ever wondered why businesses with global teams should focus on international payroll compliance? Don’t worry, this section explains why it is critical for global workforce management, highlighting its impact on both the business and employees.

Risk of Non-Copliance

Non-compliance in payroll for global teams can cause serious business risks. Mistakes in managing global payroll and compliance can result in substantial financial penalties from local governments. You may need to deal with heavy fines or back-pay obligations. Besides, it can disrupt cash flow.

Apart from this, this can damage the company’s reputation, reducing trust among clients, investors, and employees. For example, misclassifying a staff member as a contractor can result in penalties, and the company can be held liable for years of fraudulent benefits.

Negative Impact On Employee Retention and Satisfaction

We all know that transparent, accurate, and on-time payments develop trust. Payroll errors, whether related to late payments or inaccurate tax deductions, can cause frustration and stress among employees. This, in turn, can affect employee morale, leading to increased turnover. A well-managed payroll system is a major element of a positive employee experience.

To overcome these side effects, let’s check out the trends that are shaping payroll compliance in 2025.

Key Trends Shaping Payroll Compliance in 2025

The global payroll and compliance landscape is evolving rapidly. To avoid mistakes and manage payroll & compliance smoothly, it is crucial to stay updated on the latest trends that are shaping it.

- New Tax Laws: Governments are updating tax regulations continuously and introducing new tax codes to deal with the changing work environment. It has made it difficult for businesses with global teams to manage these things.

- Remote Work: The demand for distributed and remote teams is rising rapidly, blurring geographical barriers. However, this has created new tax and compliance issues for organizations with employees working from various countries. It is predicted that by 2025, more than 82 percent of companies will adopt a hybrid work model. That means there would be a massive demand for a more innovative and flexible approach to payroll systems.

- Data Privacy: With the global regulations such as LGPD, GDPR, and PDPA leading the change, organizations are being compelled to rethink how they handle employee payroll data. Stricter enforcement of these regulations has changed the way companies collect and transfer data across borders. The focus is now more on protecting employee data and ensuring legal compliance.

Now, let’s learn about structuring a global payroll and compliance team.

Structuring A Global Payroll & Compliance Team

A successful Payroll and Compliance Management approach starts with creating the right team. As businesses are expanding globally today, they may face issues with managing various tax systems, labor laws, cultural diversification, and more. With a dedicated payroll team, they can ensure that all these complexities are managed with consistency and precision.

The following section helps us to understand how to build a global payroll and compliance team, define roles, and train them to navigate the complex landscape of international Payroll and Compliance Management.

Centralized Vs Decentralized Vs Hybrid Models

Selecting the right model for your global payroll team is crucial to ensure smooth payroll compliance for global teams. And you can opt for the following models based on your requirements:

- Centralized Payroll Model

It offers businesses control, efficiency, and consistency across different countries of operation. It enables centralized oversight, and you can enforce standard practices smoothly. Also, centralized payroll offers the advantage of automation and data integration technologies to streamline processes. - Decentralized Payroll Model

This type of payroll system offers local expertise along with flexibility, helping businesses enter new markets. This model places teams in every country, bringing local knowledge to the table. However, it may affect control and consistency. It can be beneficial for businesses looking for a tailored payroll and compliance solution to meet their specific needs while dealing with diverse labor markets. - Hybrid Model

This model combines elements of decentralized and centralized payroll models. With this, you will enjoy centralized control with the flexibility to manage localized payroll. The model utilizes a centralized hub for governance and strategy with local execution. It is an ideal choice for growing businesses.

Role & Responsibilities

A successful International Payroll Compliance team requires a combination of expertise and skills. These are:

- Local Compliance Leads: These experts serve as in-country experts and help the company to keep up with local payroll taxes, labor laws, social security, and more.

- Global Payroll Manager: They are responsible for overseeing vendor relationships, strategy, payroll systems, policy implementation, and more.

- Auditors: A global payroll and compliance team should have a skilled auditor who can conduct external and internal audits regularly. These experts are responsible for ensuring compliance and accuracy.

Skills Required

- Local Labor Knowledge

Professionals must understand local labor laws, including employment classifications, wage regulations, and benefits. This will help you ensure legal adherence in every region. - Data Privacy Expertise

Another important skill to consider here is expertise in data privacy. Remember that managing sensitive employee data across countries requires strict compliance with necessary standards. So, companies should know how to use access controls, legal frameworks, and encryption to ensure the safety of sensitive information. - Financial Accuracy

Accuracy in global payroll calculation is important. Your team should be capable enough to handle social contributions, tax deductions, currency conversions, and more with maximum accuracy. Errors in this can lead to penalties and damaged reputation.

Training and Onboarding Compliance Staff

The training and onboarding process plays an important role in global payroll success. By offering continuous training, you can keep your team updated on changing payroll laws.

On the other hand, a structured onboarding process ensures new team members understand the company’s policies, work culture, local regulations, and standards. This way, you can reduce compliance risks and boost consistency across your global operations.

Now, let’s move forward with the ideal framework of a global payroll and compliance that will help you run the whole system effortlessly.

The Global Payroll & Compliance Framework

To smoothly manage your global teams, you need a solid framework that clearly establishes order while ensuring legal adherence. The following points can be the core Global Payroll Compliance Best Practices and crucial pillars to establish a scalable and robust global payroll system.

Employee Classification & Contracts

The first step is to distinguish between independent contractors and employees in every country to eliminate the risk of legal penalties. Accurate classification of employees ensures financial accuracy.

Tax & Social Security Compliance

Ensure timely social security contributions, accurate withholding of taxes, and precise filings in every jurisdiction to maintain payroll compliance for remote/distributed teams. Well, if possible, try to automate some processes to avoid human errors and enhance audit readiness.

Compensation, Benefits & Statutory Requirements

Design a compensation system that complies with local laws. Ensure that it meets local mandates for overtime pay, minimum wage, mandatory employee benefits, paid leave, etc. This will help you reduce disputes while keeping your global team satisfied.

Reporting & Filings Across Countries

Remember that every region has its own formats and deadlines for submitting taxes, payroll, labor reports, and social security information. Submit the required information on time to maintain transparency and avoid penalties.

Pay Frequency Rules, Pay Cycles & Multi-Currency Challenges

It is common to face challenges in multi-currency conversion while managing global teams. Well, you can make it smooth by deploying a system that can manage multi-currency payments utilizing updated exchange rates. These systems can also help you manage diverse payment frequencies and cycles, such as bi-weekly, weekly, or monthly. The focus here should be to ensure all payments are completed on time.

When dealing with global clients, the top priority for every business is to maintain data privacy and cross-border regulations. Our next section is all about it. Let’s explore.

Data Privacy & Cross-Border Regulations

As discussed above, ensuring employee data privacy in payroll compliance is a crucial thing that every business should prioritize. Here, we have outlined some major considerations and global payroll compliance best practices to handle cross-border data legally and securely. Have a look.

Global Data Privacy Laws

While managing global payroll and compliance, it is crucial to follow the laws such as GDPR (European Union), PIPL ( China), CCPA (United States), DPDP Act (India), and LGPD (Brazil). These laws control how data is gathered, stored, and processed. Payroll data also comes under these laws.

Payroll Data Security Measures

Ensuring payroll data security is vital for every business. For this, they can deploy effective measures such as MFA or Multi-Factor Authentication, data encryption, access controls, and regular backups.

Handling Cross-Border Payroll Data Transfers Legally

Utilise various legal mechanisms such as BCRs- Binding Corporate Rules or SCCs- Standard Contractual Clauses to transfer sensitive data, including payroll data, lawfully across regions.

Now, let’s know about the tools and technologies that work best for handling the global payroll and compliance swiftly.

Tools & Technology for Global Payroll

Smooth payroll and compliance management is not just about following laws and regulations; it also requires precision, efficiency, and scalability. This is where modern technology comes into play. With the right tool, you can automate this complex process. Besides, it can offer real-time visibility into payroll and compliance across borders.

HRIS, Payroll Systems, and Time Tracking Integrations

A modern payroll setup for a global team starts with a perfect integration between HRIS or Human Resource Information System, a robust payroll system, and time tracking tools. In this setup, the HRIS functions as a source for getting employee data, from personal details and compensation to employment agreements and benefits. It works as a central hub, ensuring data consistency across global offices. It then feeds employee data into the payroll system. This system is responsible for accurate calculations, payments, and tax withholding.

On the other hand, an integrated time tracking tool ensures that every hour of contract or hourly workers is recorded and invoiced as per local labor laws. All these things automate a process where there are chances of significant errors if handled manually.

Criteria for Selecting Global Payroll Software

Not all global payroll systems are the same. So, while choosing one, you need to consider some important factors, like:

- Country Coverage: Ensure that the software you want to use supports the unique tax and legal requirements of countries where you operate. It should offer support for pay cycle, statutory reporting, and more.

- Compliance Support: Make sure that global payroll compliance is ensured by industry experts, and the service provider has a successful track record. Ensure that they can offer advice on changing tax rules, payroll regulations, and other regulatory changes.

- System Integration: Choose one that can be easily integrated with your existing ERP, finance, and HR platforms to create an end-to-end and streamlined process. Make sure that the tools offer an open API for this.

Automation Examples

Automation is a crucial feature of modern payroll software. It helps you reduce errors and save time by automating multiple tasks related to Payroll and Compliance Management. In fact, more than 83 percent of businesses have reported that automation has improved their payroll accuracy. While choosing one, ensure that the tool can automate things like:

- Timesheets: Employees can clock in and out using an app or digital tool. The tool can generate detailed timesheets based on the logs.

- Tax Deduction: A reliable software can calculate tax deduction automatically based on local tax laws, pay rate, and employee data. Besides, it ensures that all dedications meet necessary tax regulations.

- Error Validations: When processing payroll data, automation can effectively identify discrepancies and errors by applying pre-defined rules and comparing data. This way, you can detect anomalies early and avoid losses.

Dashboards & Alerts For Compliance Monitoring

A good global payroll system offers a centralized view of all payroll KPIs through interactive, easy-to-use dashboards. You can easily check error rates, on-time payments, compliance costs, and other important KPIs with a few simple clicks. Furthermore, these systems can offer custom alerts, notifying you about regulatory changes, missed filings, upcoming deadlines, data inconsistencies, and more.

While preparing your Payroll Compliance Checklist, consider this point. With the help of the right technology, you can streamline the Global Payroll and Compliance process while increasing transparency across regions.

Once you have chosen the right tools for global payroll, it’s time to start working on standardizing the process and ensuring compliance. For this purpose, we have curated some playbooks, templates, and country examples.

Playbooks, Templates, and Country Examples

Building Country-Specific Payroll Compliance Playbooks

Begin by creating detailed playbooks for each country, covering key points such as pay cycles, labor laws, reporting procedures, and statutory benefits. These playbooks will serve as a guide, helping teams process payroll consistently and accurately.

Templates

Use standardized templates to manage and organize major tasks. While working on templates, you can consider including the following things:

- Missclassification Questionnaire: To help HR teams classify workers as contractors and employees.

Payroll Calendar: To map out payroll deadlines and pay dates, ensuring accurate processing. - Audit Evidence Checklist: It covers all the necessary documents that your team needs for an accurate payroll audit. This reduces potential disruptions.

- Compliance Register: It functions as a central record of payroll compliance obligations and helps ensure no requirement is missed.

Mini Playbooks For UK, US, Brazil, UAE, And India

When creating mini-playbooks, it is important to cover the most common global markets and explain their rules.

United States: Companies should follow the state, local, and federal wage and hour laws. They need to understand minimum wage, tax withholding, etc. The U.S. Department of Labor may impose heavy fines if companies fail to follow the rules.

UK: It focuses on following HMRC rules, National Insurance contributions, income tax, and more. Companies should pay the National Minimum Wage to employees. For non-compliance, HMRC can issue back-pay orders and penalties.

UAE: Organizations need to follow the UAE Labor law, which clearly outlines overtime time, minimum wage, and end-of-service benefits. Non-compliance with this law can lead to penalties, and companies may not be allowed to hire new employees.

India: It offers information about different statutory requirements, such as Employee State Insurance, Provident Fund, professional taxes, and more. Every company should follow the Payment of Wages Act.

Brazil: Navigating payroll for a team working in Brazil means dealing with complex labor union fees, mandatory employee benefits, tax filings, and more. Non-compliance can lead to potential legal actions and fines from regulatory bodies and employees.

Now, let’s talk about the governance, controls, and audit readiness while managing payroll and compliance for Global teams.

Governance, Controls, and Audit Readiness

Creating a robust governance framework can help you ensure accountability, consistency, and audit readiness.

Internal Controls

Establish clear internal controls in your company. That means focus should be on segregating duties and creating multiple approval points. This will reduce the risk of errors and fraud, ensuring verifiable and transparent payroll processes.

Payroll Policy Documentation

Create a central payroll policy covering both local and global payroll processes. This will help you maintain consistency and transparency while offering the required flexibility.

Audit Evidence Requirements & Retention Timelines

Every business should understand what evidence is necessary for audits and how long it should retain the evidence. Based on the country, it can range from 5 to 7 years. Proper documentation will ensure audit readiness, eliminating the risk of legal issues.

Managing Regulation Changes & System Migrations

Organizations should use structured protocols and take the help of experts while updating or migrating their payroll systems. It helps reduce disruption while maintaining accuracy. It is common to face payroll issues during migration. So, it should be handled carefully.

Now, when it comes to ensuring payroll compliance, it is vital to understand how to manage the multiple financial mechanics involved in global payroll. For this, you must consider things like payments, currency, and treasury risks. Our next section is all about it.

Payments, Currency & Treasury Risks

Understanding the nitty-gritty of payments, global currency, and treasury risks will help you handle the payroll system with ease and minimal hurdles.

Multi-Currency Payroll Management

With the right multi-currency payroll compliance best practices, you can simplify this process. Establish a standardized process to ensure accurate payments and manage the complexities of exchange rates effectively. Use reconciliation tools and real-time exchange rate tracking to avoid errors.

Exchange Rate Handling & Payment Cut-Offs

Every company should establish a clear and consistent process to decide exchange rates and set payment cut-off durations. They should work closely with the finance or treasury team to ensure correct payment schedules and on-time disbursement of salary.

Local Banking & Compliance With Payment Regulations

One of the best ways to simplify the payment process is by partnering with local banks. Through this, businesses can use country-specific payment gateways and ensure compliance with local payment regulations.

Dealing With Delayed or Failed Payments

Don’t forget to prepare solid contingency plans to deal with payment failures or delays. For example, there should be an emergency funding facility or proactive communication strategies to maintain operational continuity and employee trust. Prefer to offer necessary support and inform employees about delays quickly.

Now, let’s derive the process of scaling and maintaining the payroll and compliance system, modulating with time.

Scaling & Continuous Compliance

Maintaining payroll compliance and adapting to growing markets requires a forward-looking and proactive strategy. Here are the things you should consider to ensure a smooth scaling while maintaining compliance.

From Pilot Countries to Global Rollout

Prefer to start with a few pilot countries and test your new payroll framework. Analyze how it works. This initial phase will allow you to address potential challenges, and then you can expand to more countries by using localized playbooks and standardized processes. Use a scalable payroll system to avoid issues during expansion.

Monitoring Regulatory Changes

Keep yourself updated about new regulations using the payroll system’s alert feature. Besides, you can also work with compliance partners or local experts to get timely guidance and insights for every jurisdiction your business operates in.

KPIs & Dashboards

Use the dashboards of payroll tools and closely monitor all key performance indicators such as compliance costs, employee satisfaction, payment accuracy, audit readiness, and more. Use the data to measure the success of the system and identify areas of improvement.

Communication With Employees For Transparency

Establish trust among your global teams by clearly communicating compliance practices, payroll policies, benefits, tax changes, system updates, etc. Transparent communication is crucial to reducing confusion and making employees trust the process.

Real-world experiences can provide you with valuable insights. Let’s check out some real-life examples and learn from their past experiences.

Case Studies & Lessons Learned

This section highlights some strategic choices and common mistakes that companies make while managing global payroll and compliance.

In-House Payroll vs EOR/PEO Model

- In-House Payroll Model: It offers complete control over the payroll process. However, it requires significant investments in staff, local expertise, and technology. Companies with an established and long-term presence. These models allow companies to customize payroll based on their requirements and policies.

- EOR or PEO: With the help of a Professional Employer Organization or an Employer of Record, businesses can enjoy low-risk and rapid expansion. A third party can efficiently handle all global payroll and compliance, allowing a business to focus on core activities.

Businesses that outsourced their payroll reduced compliance risk by around 40 percent. They also witnessed a 49 percent decrease in their compliance mistakes. Some well-known global PEO providers are PAPAYA Global, Global Payroll, Deel, TriNet, Paychex, and Justworks.

Selecting between EOR vs PEO vs in-house payroll compliance depends on your geographical reach, team size, and the level of control you want.

Common Mistakes Global Teams Make and How to Avoid Them

Here are the most common mistakes related to global payroll and compliance, and how to avoid them.

- Underestimating Complexity: It is wrong to assume one region’s rules will work in other regions.

- Lack of Automation: Manual payroll processes are prone to error. Simplify them with advanced tools.

- Avoiding Data Privacy: Focus on payroll data security and follow all the guidelines.

- Ignoring Local Expertise: Work with local experts or in-country partners closely to avoid issues.

Conclusion & Action Plan

Building and managing a global payroll and compliance system is a strategic journey. This process requires a robust technological framework, thoughtful planning, a dedicated team, cross-functional collaboration, and continuous monitoring. By following these Global Payroll Compliance Best Practices, you can create a compliant payroll system that can help you maintain a positive employee experience while remaining compliant.

To assist you in getting started with this and ensuring payroll compliance for remote/distributed teams, here is a manageable 90-day roadmap that can help you establish a strong foundation.

Action Plan:

Days 1 to 30: Begin with a detailed audit of the existing payroll practices. Understand the gaps in data security, country-specific needs, compliance, and reporting accuracy. Involve stakeholders across legal, finance, and HR departments. Then, select a payroll model.

Days 31 to 40: Create country-specific templates and playbooks. Ensure that the paybooks include misclassification checklists, payroll calendars, audit documentation rules, benefits, etc.

Days 41 to 60: Then, choose the right technology by considering the features you need. Prefer to opt for robust HRIS and automation systems. Train your team on new workflows. Don’t forget to create an effective data migration plan.

Days 61 to 90: Test the new system in the pilot countries and check its accuracy and scalability before global rollout.

With the right strategy in place, global payroll will become a competitive advantage for your business.

Implementing Employee Management Applications like Mera Monitor can provide you with accurate data on employees and their progress in the organization, which in turn can result in high accuracy of payroll and compliance. It is an ideal employee/productivity management system for all in-house, remote, hybrid, or global teams with different time zones. It overall makes your payroll and compliance management effortless. You can also integrate it with various payroll management systems to streamline the process.

Get a Mera Monitor Subscription today to manage mandatory details for payroll and compliance of all your teams effortlessly.

FAQs

Payroll non-compliance can lead to financial penalties, legal issues, reputational damage, and a loss of trust among employees. Mismanaging employee classification, taxes, or social security contributions can create significant operational and legal challenges.

Businesses should implement a structured payroll framework covering employee classification, tax compliance, social security contributions, and local pay cycles. Using integrated HRIS, payroll systems, and time-tracking tools can automate calculations and reduce errors.

Payroll data contains sensitive employee information. Businesses must ensure secure storage, legal cross-border transfers, and compliance with global data privacy laws to protect employee data and maintain legal adherence.

In-house payroll provides control but requires expertise, staff, and systems. Outsourcing to an Employer of Record (EOR) or Professional Employer Organization (PEO) can reduce compliance risks and simplify global operations, though it offers less direct control.

Clear communication, timely payments, and automated systems for tax deductions, timesheets, and compliance checks help reduce payroll errors. A consistent and transparent payroll process builds trust and enhances the employee experience.

Gift Card ₹999

Gift Card ₹999