Introduction

If you’ve ever looked at a timesheet and thought, “That seems a little too perfect,” you’re not alone. Over the last decade, I’ve audited dozens of teams across IT, construction, and healthcare—and I’ve seen timesheet fraud quietly eat into payroll, inflate project costs, and undermine trust.

Timesheet fraud isn’t always dramatic—it often hides in small, repeated behaviours that add up to serious losses. The good news? With the right mix of policy, technology, and culture, it can be detected and prevented.

TL;DR – Quick Summary

- Timesheet fraud = falsifying or manipulating work hours.

- It can cost businesses upto 5% of total payroll annually.

- Common tactics: buddy punching, padding hours, falsifying overtime.

- Red flags: repeated round numbers, frequent edits, idle time logged as active.

- Best prevention: clear policies + smart tools + manager awareness.

Is Falsifying Timesheets Illegal?

Short answer: yes.

Employers are legally required to keep accurate records of hours worked. In the U.S., the Fair Labor Standards Act (FLSA) makes falsifying timesheets a violation of federal law. Employers can face fines, lawsuits, and back pay penalties if records are inaccurate [U.S. Department of Labor – FLSA Recordkeeping Requirements].

What many companies don’t realize: if employees falsify timesheets, the employer is still held liable. And in some countries, fraudulent time reporting can even carry criminal penalties.

👉 This isn’t just an “HR problem.” It’s a legal and financial liability every organization must take seriously.

Timesheet Fraud vs. Time Theft vs. Errors

It’s important to separate concepts:

| Term | What It Means | Example | How to Handle It |

|---|---|---|---|

| Timesheet Fraud | Intentional falsification of hours | Logging 9 hours when you only worked 7 | Disciplinary action, potential termination |

| Time Theft | Non-work activities during paid hours | Browsing social media for 1 hour | Coaching, productivity monitoring |

| Errors | Honest mistakes or forgetfulness | Forgetting to clock out for lunch | Correction + training |

👉 Why it matters: Fraud = deliberate. Theft = behavioural. Errors = fixable. Your response should fit the category.

The Hidden Toll on Businesses

Timesheet fraud doesn’t just pad payroll. It ripples through the business:

- Payroll Costs: The American Payroll Association (APA) estimates time theft and timesheet inaccuracies can cost businesses up to 5% of gross annual payroll.

- Project Overruns: False time entries distort project budgets and resource forecasts.

- Compliance Risk: Regulators can fine companies for inaccurate records, even if fraud was employee-driven.

- Culture Impact: If employees believe “everyone does it,” fraud becomes normalized.

💡 Real-Life Example: A mid-size IT services company I worked with found that just 15 minutes of daily “padded time” across 200 employees added up to ₹40 lakhs a year—nearly the cost of hiring five additional staff.

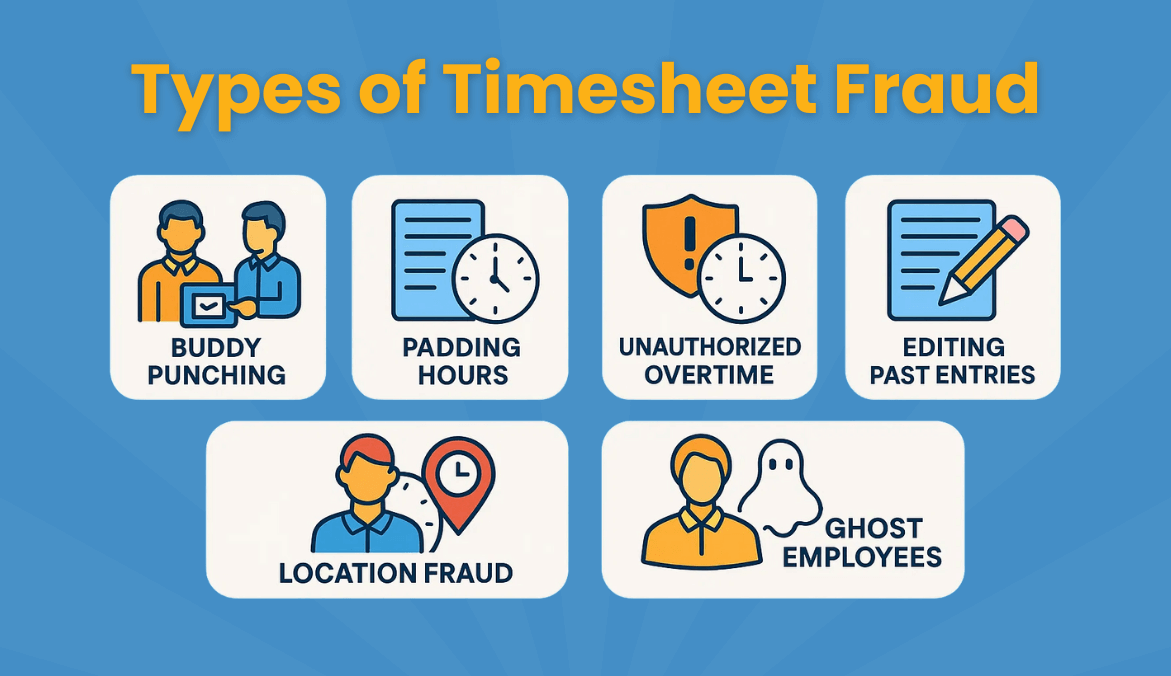

Types of Timesheet Fraud (With Examples)

Fraud takes many forms, but here are the most common:

- Buddy Punching – One employee clocks in/out for another.

- Example: On a construction site, two workers swapped ID badges to cover late arrivals. GPS logs finally exposed the mismatch.

- Padding Hours – Employees record longer shifts than worked, or round up consistently.

- Example: Remote workers logging “exactly 8.0” hours daily, regardless of task output.

- Unauthorized Overtime – Employees clock in early or stay late without approval.

- Editing Past Entries – Adjusting old logs to inflate hours after approval windows.

- Location Fraud – Logging time from the wrong location (e.g., at home instead of a client site).

- Ghost Employees – Payroll includes fake workers who “submit” timesheets.

- Buddy Punching – One employee clocks in/out for another.

👉 Pro Tip: Fraudsters adapt to the system in place. That’s why layered defenses—policy + tech + audits—are essential.

Red Flags & Detection Signals

Here’s what I tell managers to watch for:

- Perfect round numbers: Consistently logging “8.0” hours with no variation.

- Frequent edits: Repeated post-submission changes to timesheets.

- Unexplained overtime: Spikes in overtime that don’t match project needs.

- Idle activity: Hours logged but no corresponding output (emails, code commits, tickets).

- Geofence mismatches: Employee clocks in from a location that doesn’t match the job site.

✅ Checklist for Managers:

- Do logs align with deliverables?

- Do hours vary naturally, or look “too neat”?

- Are edits tracked and explained?

👉 Rule of Thumb: Real work is messy. If timesheets look too perfect, dig deeper.

Why Timesheet Fraud Happens

In my experience, fraud isn’t always about “bad employees.” Root causes include:

- Manual Processes – Paper sheets and editable spreadsheets invite manipulation.

- Unclear Policies – Employees aren’t sure what counts as overtime or reportable hours.

- Manager Pressure – Some pad hours to meet expectations.

- Cultural Tolerance – If “everyone adds 15 minutes,” soon it’s the norm.

How to Detect Timesheet Fraud

Detection works best when multiple methods are combined:

- Cross-Check Systems – Compare timesheets with project data (Jira, CRM, GitHub).

- Audit Trails – Lock timesheets after approval and log all edits.

- Anomaly Reports – Use tools that flag unusual patterns (excessive overtime, round numbers).

- GPS/Biometrics – For field roles, geofencing and facial recognition are effective.

- Anonymous Tips – Encourage employees to report fraud safely.

How Mera Monitor Can Help Detect Timesheet Fraud

Most timesheet fraud isn’t obvious. It hides in “normal-looking” records—perfect 8-hour shifts, unexplained overtime, or vanishing breaks. On the surface, it looks fine. In reality, it drains resources and eats into profits.

Mera Monitor exposes these hidden gaps with features built for fraud detection:

- Automated Timesheets – Captures every login, logout, and break in real time. No manual edits, no silent padding of hours.

- Active vs. Idle Time Tracking – Breaks down real work versus idle time so unproductive hours can’t be disguised as effort.

- Attendance + Activity Verification – Connects clock-ins with actual activity across apps, websites, and screens. If someone “clocks in” but isn’t working, it’s clear.

- Fraud Red Flags – Instantly highlights suspicious patterns: rounded shifts, unusual overtime, repeated edits—classic fraud signals.

- Task & Project-Level Visibility – Matches logged hours with actual deliverables, exposing inflated time entries that don’t align with output.

💡 Pro Insight: Fraud doesn’t shout—it creeps in through repeated small patterns. With Mera Monitor, those patterns stand out early, giving managers the clarity to act before losses grow.

👉 Start a Free Trial or Book a Demo to see how Mera Monitor helps you.

How to Prevent Timesheet Fraud (Without Killing Trust)

Preventing timesheet fraud isn’t just about catching bad behaviour—it’s about building a system where fraud becomes hard to do, easy to detect, and unnecessary in the first place. Here’s how to approach it in a balanced way:

1. Create a Clear Timesheet Policy

- Define Fraud: Spell out exactly what counts as falsification (buddy punching, unauthorized overtime, editing past entries).

- Consequences: Outline progressive discipline—first offense = warning, repeated = escalation, deliberate fraud = termination.

- Employee Acknowledgment: Have staff sign off on the policy so there’s no “I didn’t know.”

Tip from experience: Companies that name examples in policies (e.g., “clocking in for someone else is fraud”) see fewer violations because there’s less gray area.

2. Automate Time Tracking

Manual processes are fraud’s best friend. Tools with built-in safeguards eliminate opportunities to manipulate hours.

- Biometrics or GPS: Stop buddy punching and off-site fraud.

- Audit Trails: Every change is logged, so managers know who edited what.

- Integrations: Sync with project management tools to cross-check logged time against deliverables.

👉 Automating doesn’t mean micromanaging—it means creating transparency that protects both employer and employee.

3. Train Managers to Spot Red Flags

Managers are the first line of defence, but most aren’t trained in fraud detection.

- Teach them to spot “too perfect” timesheets, unusual overtime, or excessive edits.

- Encourage proactive check-ins: “I noticed your hours spiked this week—what’s going on?”

- Give them tools + authority to escalate when something looks off.

💡 From my audits: Fraud often goes unchecked because managers assume “payroll will catch it.” In reality, payroll just processes numbers—they rarely investigate patterns.

4. Build a Culture of Transparency, Not Fear

Fraud prevention only works if employees don’t feel micromanaged.

- Explain the Why: Tell employees accurate time tracking ensures fair pay, prevents overwork, and builds client trust.

- Recognize Honesty: Acknowledge teams who consistently submit accurate records.

- Provide Safe Channels: Allow employees to flag fraud or errors anonymously.

👉 When employees feel prevention is about fairness, not surveillance, they’re far more likely to comply.

5. Implement Smart Approvals and Checks

- Dual Approvals: Require both employee + manager confirmation for overtime.

- Threshold Alerts: Flag when hours exceed a set norm (e.g., 20% higher than average).

- Random Spot Checks: Periodic audits keep everyone honest without creating fear.

💡 Real-world example: One healthcare client reduced fraudulent overtime by 30% simply by adding a second approval step for hours over 40 per week.

6. Lead by Example

Leaders and managers must set the tone. If they cut corners or ignore discrepancies, employees will follow.

- Enforce policies consistently, even at senior levels.

- Show you value accuracy by reviewing reports yourself, not just delegating.

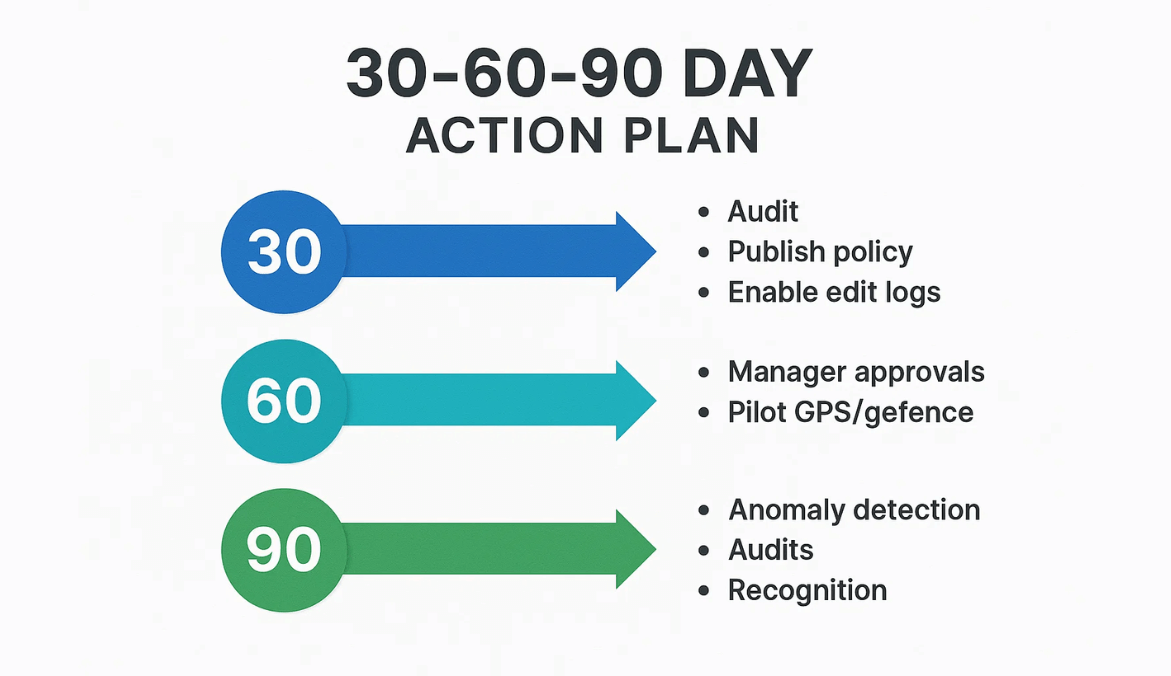

30-60-90 Day Action Plan

30 Days:

- Audit existing timesheets.

- Publish policy & communicate expectations.

- Enable edit logs.

60 Days:

- Add manager approvals for overtime.

- Pilot GPS/geofence tracking in field teams.

90 Days:

- Roll out anomaly detection reports.

- Run quarterly audits.

- Recognize teams for compliance.

Industry Playbooks

Different industries, different risks:

- Construction & Field Services: Geofencing, biometric site check-ins, GPS logs.

- Remote Teams: Tie hours to deliverables, not just “time logged.”

- Example: One startup I advised cut suspicious timesheet activity by 50% after requiring logs linked to deliverables.

- Healthcare/Retail: Sync scheduling with time logs; flag overtime spikes automatically.

Tools & Templates

Tools to Detect & Prevent Timesheet Fraud

- Mera Monitor – Employee monitoring with automated timesheets, idle vs. active tracking, screen monitoring, and analytics to flag fraud early.

- Time Champ – Tracks productivity, geo-location, and attendance with real-time reports to minimize falsified hours.

- We360 – AI-driven monitoring that converts activity logs into insights to detect padding or suspicious edits.

- EmpMonitor – Provides precise timesheets, attendance tracking, and insider threat detection for fraud prevention.

- WorkStatus – Background tracking of hours and app usage with detailed reports to highlight time theft.

Templates to Strengthen Your Policy

📑 Timesheet Fraud Policy Template – Clear rules employees acknowledge.

📋 Audit Checklist for Managers – Quick review to catch red flags.

🕵️ Investigation Log Sheet – Organized record for suspected cases.

🗣️ Manager Conversation Script – Guidance for handling first offenses professionally.

📥 Download the full Timesheet Fraud Toolkit PDF – Includes all templates in one place.

Final Takeaway

Timesheet fraud may look small on paper, but it drains money, trust, and compliance over time. The fix isn’t complicated: combine policy, technology, and culture to set clear expectations and prevent abuse.

Remember: patterns that look too perfect are usually where fraud hides. Don’t ignore the signals, and don’t be afraid to have tough conversations.

With the right approach, you’ll protect your payroll, your projects, and your people.

FAQs

The APA estimates eliminating timesheet fraud and time theft can save companies upto 5% of payroll, often millions for mid-to-large businesses.

Gift Card ₹999

Gift Card ₹999