Introduction

If you’ve ever stared at a timesheet thinking, “This should be simple… so why does it feel confusing?” — you’re not alone.

In practice, most time calculation issues don’t come from people working less or more. They come from small inconsistencies breaks not deducted, hours not converted properly, or overtime calculated differently by different people.

Payroll errors are far more common than most teams realize. An Ernst & Young (EY) survey found that one in five U.S. payrolls contains errors, and each error costs an average of $291 to identify and fix. Small inconsistencies in break deductions, decimal conversion, or overtime rules quickly add up—making accurate time calculation critical from day one.

This guide — and the calculator above — is built from 10+ years of hands-on experience working with teams managing payroll, projects, and work hours, where accuracy mattered more than assumptions.

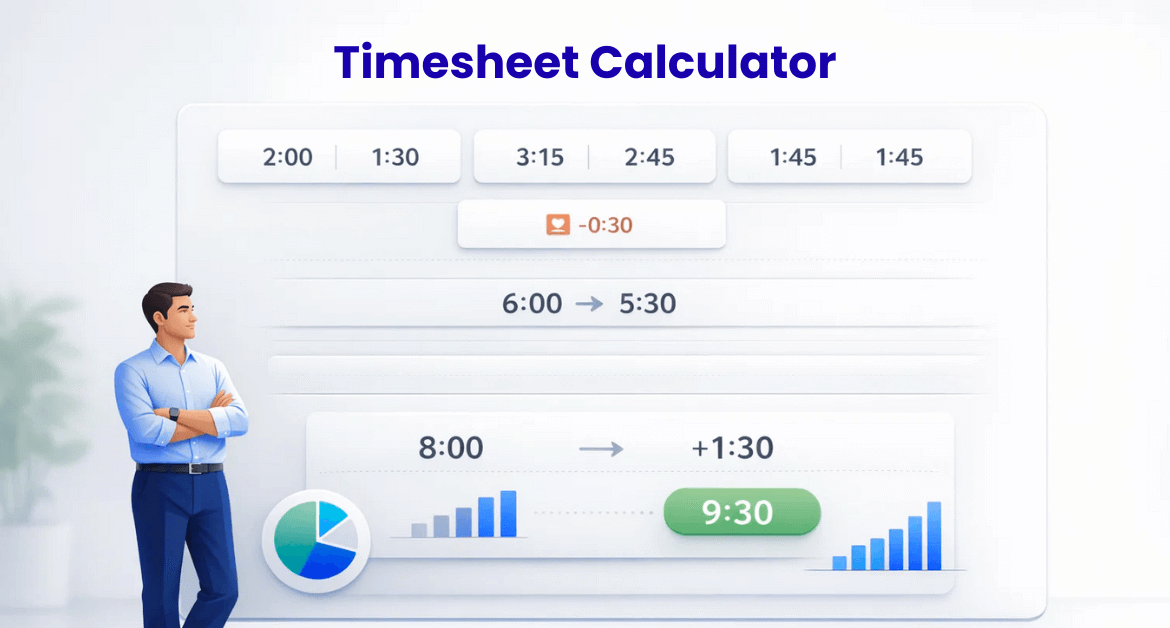

Use the timesheet calculator above to instantly calculate:

- Total work hours

- Break-adjusted time

- Decimal hours (for payroll)

- Overtime and pay (optional)

No signup. No spreadsheets. Just clarity.

Timesheet Calculator

Track your work hours and calculate pay

Time Entries

Weekly Summary

Pay Calculation

Estimated Pay

Hours Visualization

Track real work time automatically with Mera Monitor

Start your free trial today and never miss a minute of your work.

Calculator Settings

What Is a Timesheet Calculator (and When Should You Use One?)

A timesheet calculator helps you calculate total hours worked based on:

- Start and end times

- Break durations

- Daily or weekly totals

- Optional overtime and pay rates

People often use the terms timesheet calculator and time card calculator interchangeably. In reality, they solve the same core problem: accurate work-hour calculation.

This isn’t a niche problem. According to the U.S. Bureau of Labor Statistics, 80.3 million workers in the U.S. were paid hourly in 2024, representing 55.6% of all wage and salary workers. For more than half the workforce, accurate timesheets directly affect pay, compliance, and trust.

When it’s most useful

- You track hours manually and want accuracy

- You need decimal hours for payroll

- You want to double-check weekly totals

- You bill clients by the hour

Actionable tip: If you’re calculating hours only at the end of the week, small errors compound quickly. Daily calculation avoids surprises.

From experience: Over the last 10+ years, I’ve seen more payroll disputes caused by unclear time calculations than by actual work issues.

How to Use the Timesheet Calculator (Step by Step)

The goal here is speed — not complexity.

Step 1: Enter start and end time

Choose either 12-hour or 24-hour format, then enter when work began and ended.

Tip: Stick to one format consistently to avoid errors.

Step 2: Add break or lunch time

Enter unpaid breaks separately.

Tip: Never “adjust” end time to account for breaks — it creates audit issues later.

Step 3: Enable rounding (optional)

Turn this on only if your organization follows rounding rules.

Tip: If rounding exists, document it and apply it consistently.

Step 4: Add hourly rate (optional)

Instantly calculate pay based on total hours.

Tip: Calculate first, approve later — never mix the two steps.

Understanding Your Results (So You Can Trust Them)

The calculator typically shows:

- Total hours (hh:mm)

- Decimal hours

- Net work time after breaks

- Overtime hours (if enabled)

- Gross pay (if rate added)

Actionable tip: Always review decimal hours before payroll — this is where most silent errors happen.

Timesheet Calculator Examples (Real Scenarios)

Example 1: Standard workday with lunch

- 9:00 AM – 6:00 PM

- 1-hour break

Result: 8 hours worked

Tip: Always deduct lunch explicitly.

Example 2: Split shift

- 9:00–1:00

- 2:00–6:00

Tip: Calculate each block separately, then total them.

Example 3: Overnight shift (crossing midnight)

- 10:00 PM – 6:00 AM

Real-world insight: Overnight shifts are one of the most common sources of timesheet errors — especially when breaks and date changes aren’t handled properly.

Tip: Always use a calculator that supports overnight logic.

Example 4: Weekly overtime

- Total hours: 46

- Overtime threshold: 40

Result:

- Regular: 40 hours

- Overtime: 6 hours

Tip: Set overtime rules before calculating hours.

Converting Timesheet Hours to Decimal (Without Mistakes)

Payroll systems require decimal hours, not time format.

Simple formula

Minutes ÷ 60 = decimal

Examples:

- 15 min = 0.25

- 30 min = 0.50

- 45 min = 0.75

From experience: Treating 1:30 as 1.30 is one of the most frequent payroll mistakes across teams.

Actionable tip: Convert minutes first — never estimate decimals.

Calculating Overtime Using a Timesheet Calculator

Most calculators allow:

- Daily overtime rules

- Weekly overtime rules

- Multiple pay rates

Actionable tip: Overtime disputes usually come from inconsistent rules, not wrong math.

Free Timesheet Templates (Google Sheets)

If you prefer offline tracking, templates help:

- Weekly timesheets

- Bi-weekly timesheets

- Project-based (billable vs non-billable)

Actionable tip: Lock formulas so users can’t accidentally overwrite calculations.

Best Practices for Accurate Timesheets

Accurate timesheets aren’t about tracking more — they’re about tracking correctly and consistently. Most errors don’t come from bad intent; they come from small habits that quietly add up over time.

Here are the best practices that consistently prevent payroll issues, billing disputes, and last-minute corrections.

Track Time Daily, Not in Batches

Recording time at the end of the week relies heavily on memory, which is rarely accurate. Small gaps, forgotten breaks, or misremembered end times can easily distort totals.

Best practice: Log time at the end of each workday. Daily tracking keeps data fresh and significantly reduces cumulative errors.

Always Deduct Breaks Explicitly

One of the most common mistakes is “adjusting” start or end times to account for lunch or breaks. This makes the timesheet harder to audit and often leads to confusion later.

Best practice: Enter the full work period first, then deduct unpaid breaks separately. This keeps calculations transparent and defensible.

Use a Single Time Format Consistently

Switching between 12-hour (AM/PM) and 24-hour formats increases the risk of incorrect entries—especially for early morning or late-night shifts.

Best practice: Choose one time format and use it consistently across all entries, teams, and pay periods.

Convert Time to Decimal Before Payroll

Payroll systems don’t understand hours and minutes—they rely on decimal values. Misconverting minutes is one of the most frequent silent errors in payroll processing.

Best practice: Always convert minutes to decimals using a calculator. Never estimate or assume values (for example, 1:30 ≠ 1.30).

Define Overtime Rules in Advance

Overtime disputes usually happen because rules are unclear or applied inconsistently—not because calculations are wrong.

Best practice: Document overtime thresholds (daily or weekly) before calculating hours, and apply the same rules to everyone.

The cost of getting overtime rules wrong can be significant. In FY 2024, the U.S. Department of Labor’s Wage and Hour Division recovered over $202 million in back wages for nearly 152,000 workers, averaging about $1,333 per worker. Clear rules and consistent calculations help prevent avoidable disputes and corrections.

Review Timesheets Before Approval

Even accurate calculations can contain incorrect inputs. A quick review catches mistakes before they affect payroll or billing.

Best practice: Scan for missing breaks, unusually long shifts, overnight entries, and decimal totals before approving timesheets.

Avoid Manual Recalculation

Manually recalculating hours after changes introduces unnecessary risk. Each manual edit increases the chance of inconsistency.

Best practice: Recalculate using the calculator instead of adjusting totals manually.

Standardize Across the Team

Accuracy breaks down when everyone follows their own method. Consistency matters more than speed.

Best practice: Use the same calculation method, break rules, rounding policies, and review process across the entire team.

Treat Accuracy as a Habit, Not a Task

Timesheet accuracy improves when it becomes part of the workflow, not a once-a-week chore.

Practical insight: Teams that build small daily habits around time tracking spend far less time resolving disputes and corrections later.

Summary: What Consistently Works

- Track time daily

- Deduct breaks clearly

- Convert to decimals before payroll

- Apply overtime rules consistently

- Review before approval

Small habits prevent big corrections.

When a Timesheet Calculator Is No Longer Enough

A calculator works well for:

- Individuals

- Small teams

- Simple tracking

But once you add:

- Multiple people

- Approvals

- Reports or audits

Manual calculation starts to break.

Practical insight: Calculators solve accuracy. Growing teams eventually need consistency and visibility across people and projects.

Final Thoughts

A timesheet calculator isn’t about tracking people — it’s about removing guesswork.

When hours, breaks, decimals, or overtime are calculated inconsistently, small errors turn into payroll disputes, billing issues, or unnecessary rework. The calculator above exists to solve exactly that problem: accurate, repeatable time calculations without spreadsheets or assumptions.

From experience, teams that get time calculations right early spend far less time fixing mistakes later. Whether you’re validating payroll, double-checking client hours, or handling overtime, a reliable calculator gives you clarity before approvals happen.

Use this timesheet calculator when accuracy matters more than speed — and when trust depends on getting the numbers right.

As teams grow and tracking becomes more complex, calculators handle the math well. At that stage, consistency, approvals, and visibility across people and projects become the next challenge.

For now, start with accuracy. Everything else builds on that.

FAQs

To calculate hours worked from a timesheet, enter the start time and end time, then subtract any unpaid breaks (such as lunch). The remaining time represents total hours worked. A timesheet calculator automates this process to avoid manual errors, especially when shifts vary day to day.

Yes. A proper timesheet calculator allows you to deduct unpaid breaks separately instead of adjusting start or end times. This is important for accuracy and audit clarity. Always enter the full work period first, then subtract break time to get net working hours.

Yes. A good timesheet calculator correctly handles overnight shifts that cross midnight, such as 10:00 PM to 6:00 AM. These shifts are a common source of errors when calculated manually, especially if dates are not handled correctly.

To convert time into decimal hours, divide the minutes by 60 and add the result to the hour value.

For example:

- 15 minutes = 0.25

- 30 minutes = 0.50

- 45 minutes = 0.75

Timesheet calculators automatically convert time into decimal format, which is required for most payroll systems.

Payroll systems calculate pay using decimal hours, not time format (hh:mm). If minutes are not converted correctly, payroll errors occur. For example, treating 1 hour 30 minutes as 1.30 instead of 1.50 leads to underpayment or overpayment.

Yes. You can calculate overtime by setting daily or weekly overtime thresholds (for example, overtime after 8 hours per day or 40 hours per week). The calculator separates regular hours and overtime hours automatically when rules are applied correctly.

Yes. Many timesheet calculators allow you to enter an hourly rate so you can calculate total pay. Some also support different rates for regular time and overtime. This is useful for payroll validation and client billing.

Yes. You can calculate daily hours and then total them for the week to validate weekly payroll or billing totals. This approach reduces cumulative errors that often happen when calculations are done only at the end of the week.

Yes. This calculator is free to use and does not require signup. It is designed for quick, accurate calculations without spreadsheets or manual formulas.

In practice, yes. Both timesheet calculators and time card calculators solve the same problem: accurately calculating work hours, breaks, and totals. The terms are often used interchangeably.

Yes. If you bill clients by the hour, a timesheet calculator helps you verify billable hours, convert time into decimals, and ensure invoices are accurate before sending them.

Common mistakes include:

- Forgetting to deduct unpaid breaks

- Incorrect decimal conversion

- Miscalculating overnight shifts

- Applying overtime rules inconsistently

- Estimating time instead of calculating it

Using a calculator helps eliminate these errors.

A timesheet calculator works well for individuals and small teams. However, when you need approvals, reporting, audits, or visibility across multiple people and projects, manual calculation becomes inefficient. At that stage, a dedicated time tracking or workforce management system is usually required.

Gift Card ₹999

Gift Card ₹999